It’s more important than ever for the payroll function to demonstrate and develop its controls, structures and practices to ensure accurate pays, adherence to workforce obligations and minimise risks inherent in payroll.

No longer is it acceptable at board level for management to delegate the risk and responsibility of payroll governance to those in the payroll department.

This toolkit contains practical, common sense ideas and tools to help you manage payroll processes, approvals and audit, so you can improve governance.

What is governance?

According to the Governance institute of Australia: Governance encompasses the system by which an organisation is controlled and operates, and the mechanisms by which it, and its people, are held to account. Ethics, risk management, compliance and administration are all elements of governance.

Here’s a quick video by the Governance Institute of Australia with more information:

Payroll governance is a subset of corporate governance and ties into the overall governance, risk and compliance (GRC) of the organisation.

“In 2020, I wrote to the boards of Australia’s top 100 ASX-listed companies, calling on them to elevate employee pay as a governance and compliance priority, and asking them to ensure they have the appropriate systems, expertise and leadership in their human resources areas – particularly in their payroll function.”

Sandra Parker PSM, Fair Work Ombudsman, Annual Report 2021-2022

Why is payroll governance important?

It allows organisations to manage and minimise risks within payroll. It also allows you to demonstrate and comply with all relevant legislation and workplace requirements, providing oversight, transparency and conformity to the whole of business governance, risk and compliance.

Good payroll governance reduces risk of:

- Under/over payments due to misinterpretation of industrial agreements

- Non-compliance against payroll and workforce obligations

- Errors causing hidden payroll liabilities

- Key person dependency

- Fraud and perception of fraud

8 essential items for Australian payroll governance

Payroll governance is the systems, mechanisms and rituals in place to enforce and define how payroll operates. Using tools and frameworks makes it easier to manage and practice good governance. Here’s 8 items every organisation should have to maintain best practice payroll governance:-

- Work schedule: A calendarised schedule of payroll recurring activities and deadlines.

- Process documentation & checklists: Documented processes and checks to ensure accuracy and consistency of how things are done.

- Payroll controls & proof of work: Controls are mechanisms to monitor activity, reduce risk, errors and perception of fraud. Proof of work is providing secure, auditable evidence work has been done.

- Reviews & hygiene checks: Calendarise and SOP’s for proactive maintenance, checks and reviews.

- Payroll registers: Formal tracking and register of errors and actions impacting payroll operations and compliance.

- Risk management: Identify, categorise and mitigate payroll risks. Develop response plans and schedule reviews and tabletop testing.

- Monitoring & reporting: Regular, structured reports to senior leaders and the ability to track and monitor payroll activities.

- Team, education & training: Defined and practiced team values, articulated skills and competencies and a program of learning and development activities for payroll staff.

Download our free Australian Payroll Governance Toolkit PDF to learn the specifics involved with these 8 items, including best practice tips and useful examples to help get you started.

Want to get payroll governance sorted in a couple days?

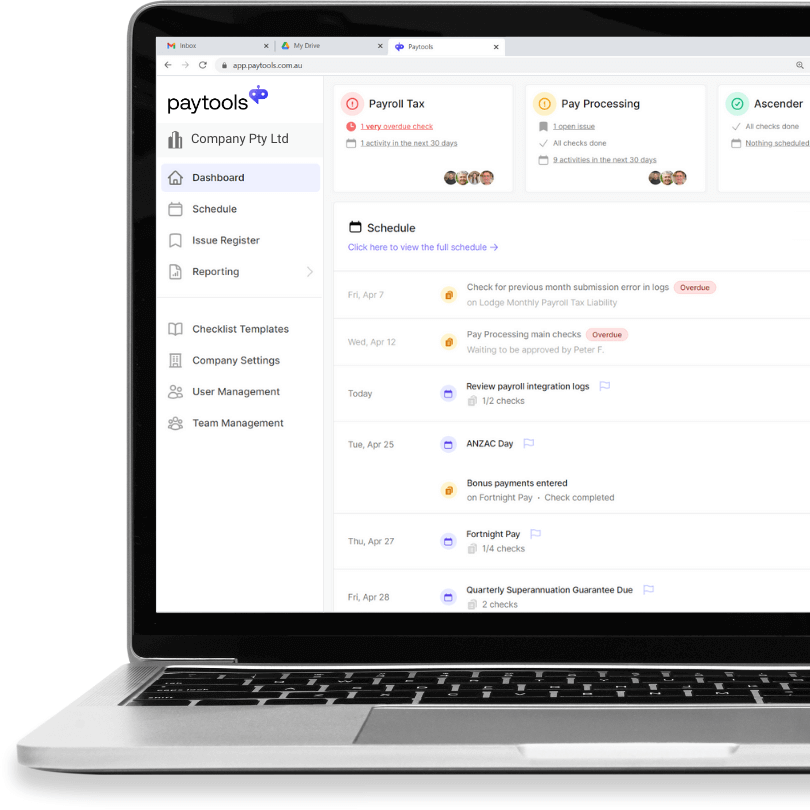

By using a dedicated payroll operations platform, you’ll reduce risk and centralise all your payroll operations without even having to think about it!

Paytools, Australia’s leading payroll operations software

Paytools brings together your operational, people and compliance management into one platform.

See how our purpose-built payroll operations platform can help you improve governance and create a sustainable payroll team.

0 Comments