For a lot of Australian organisations, the payroll function is under-invested and under-resourced, with potential dangers lurking below the surface.

A recent AFR interview with Tracy Angwin, CEO at Australian Payroll Association, reinforced some hard hitting issues that surround payroll:

“Perhaps the most alarming thing we see is the trend of senior management not understanding the payroll structure required to ensure a well-governed, compliant and efficient payroll,”

“The number of senior company executives quietly admitting to us that they have no idea what is going on in their company’s payroll function is astounding”, Ms Angwin said.

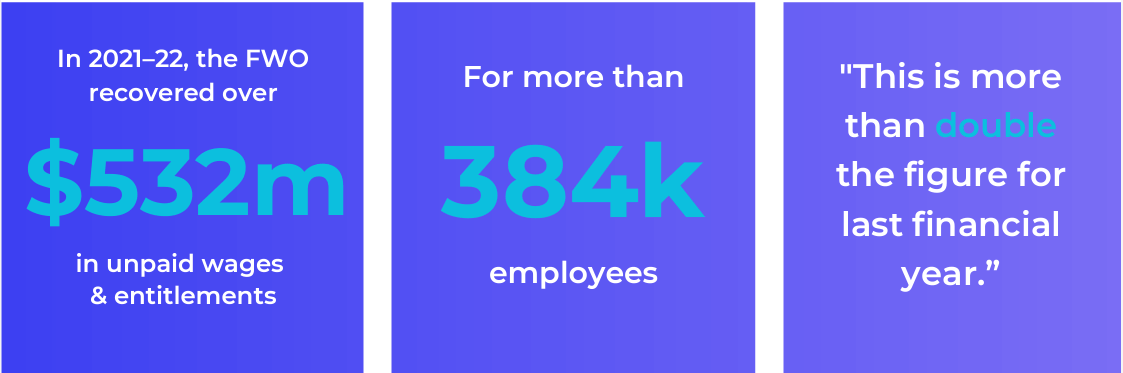

We saw similar concerns in the Fair Work Annual Report FY22:

Payroll risks you should be across

Operational risk

The 4 key areas to review in operations are:

- Record keeping

- Processes

- Transparency & oversight

- Controls & segregation

People risk

The most common issues relating to your people include:

- Risk of staff burnout

- Key person dependency

- Failure to plan for ‘if things go wrong’

- Lack of training & development

Compliance risk

What is important to payroll in terms of compliance?

- Identifying & understanding the relevant legislation

- Keeping up with changes

- Compliance & audit tracking

Want help to determine if your organisation is at risk for any of these 3 areas?

Download our free PDF whitepaper. We’ve outlined a list of questions to help you surface any issues that might be present.

How to mitigate payroll risk

What should you be doing?

Here’s 3 tips to ensure you’re payroll team is set up for success:

1. Formalise governance structures: To improve compliance & accountability (this includes centralising payroll operations management, plus conducting regular audits and reviews).

2. Invest in your people: Strong governance & operations structures assist in reducing employee burnout, as well as demonstrate workload requirements. You should also have a focus on hiring the right people and continually developing the staff you have.

3. Invest in payroll operations technology: This is important – Payroll systems can’t do everything! They are not designed to manage payroll governance or your day-to-day operations. Payroll governance tech allows you to centralise payroll operations, better manage knowledge & provides a formal audit trail of all operations & record keeping.

For more information, download our free whitepaper: Managing payroll risk [PDF].

Steps to get started

If your payroll operations and knowledge scattered across spreadsheets, email, personal calendars and documents – that’s not good governance.

Paytools, Australia’s leading payroll operations software can help.

It will reduce payroll risk in your organisation by creating consistent and accountable payroll operations. Get in touch to see how you can build an air tight and fully auditable payroll governance program in days, not weeks.