Turn payroll complexity into a repeatable science

Paytools provides a high-performance framework to manage payroll operations, track ad-hoc employee events & strengthen your governance.

Our customers are setting a new standard for payroll

Payroll shouldn’t feel like a high-stakes gamble

Most payroll teams are one absence away from a crisis. If you’re still relying on any of these, you’re at risk:

Excel Checklist Chaos

Checklists & processes copied each pay period in multiple spreadsheets.

The “Memory Trap”

Critical tasks & deadlines living only in the minds of senior staff.

Stuck in the BAU

Too busy in your day-to-day to focus on strategic payroll.

Audit Anxiety

Scrambling to find evidence of compliance for auditors.

Finally, a single source of truth for your payroll office

Move away from disconnected spreadsheets and “memory-based” processes. Paytools centralises your recurring cycles, ad-hoc employee changes and compliance obligations into one governed platform.

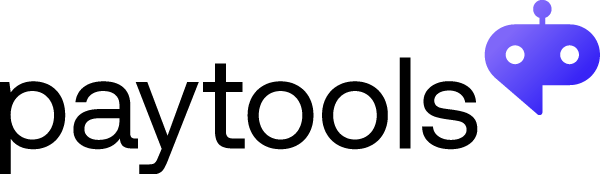

PAYROLL OPERATIONS

The engine for your recurring pay cycles

Centralise your team’s collective knowledge into a repeatable system that ensures every pay run is identical in quality and accuracy, regardless of who is in the office.

Learn more →

EMPLOYEE EVENTS

The control centre for ad-hoc, reactive work

Stop managing new starters, terminations and pay variations via sticky notes and “lost” emails. Capture every individual employee change in a governed registry with dedicated workflows that ensure no detail is missed.

Learn more →

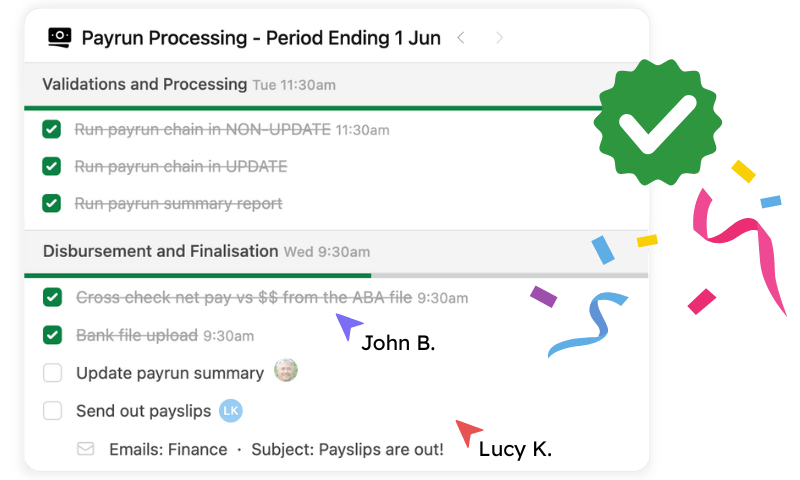

GOVERNANCE HUB

Instantly improve payroll governance & oversight

Go beyond just “getting people paid” to proving you did it correctly. Create a permanent, searchable evidence trail of every decision, legislative check and approval, making your operation truly “audit-ready” 365 days a year.

Learn more →

How does Paytools change payroll?

Reduce processing errors & missed obligations.

Create efficiencies with automated workflows.

Improve collaboration & reduce key person dependency.

Enhance visibility & verification of critical operations.

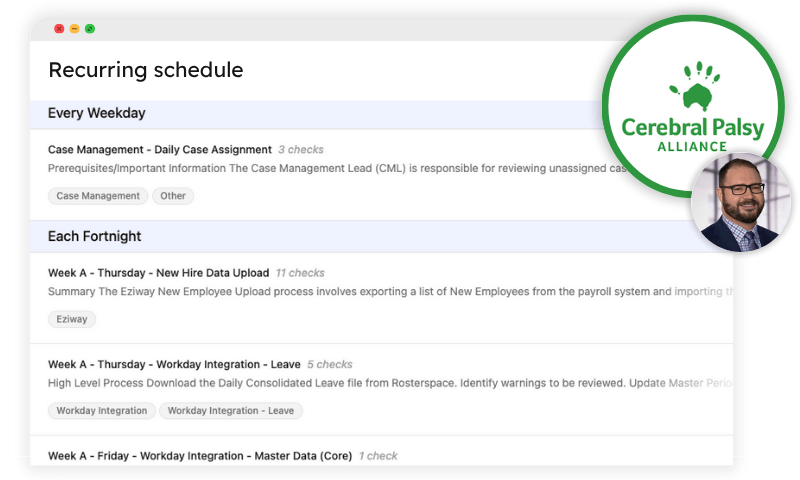

We now have full transparency of payroll operations, obligations, issues and risks.

Paytools provides a clear, structured view of all critical payroll activities, ensuring nothing gets missed.

– Dan Watson, Senior Manager, Payroll

Learn how CPA are redefining payroll management →

FAQs

Is Paytools a payroll system?

No, Paytools is a payroll operations platform. Think of your payroll system (like SAP, Workday or Chris21) as the engine that calculates the numbers.

Paytools is the cockpit – it’s where you manage the team, track the deadlines, document the procedures and house the governance that ensures those calculations are correct.

We sit on top of your existing software to manage the “human” side of the process.

How does Paytools handle our payroll data?

It doesn’t – and that’s by design. Paytools tracks the tasks, approvals, and obligations of your team, not the sensitive financial data of your employees.

By keeping payroll data in your payroll system and process data in Paytools, you maintain a higher security posture while ensuring your team has a clear, governed roadmap for every pay cycle.

Is Paytools difficult to set up?

Not at all. We handle the heavy lifting by helping you move your existing checklists and processes into the platform.

Because we don’t require access to your sensitive payroll data (PII), we bypass the typical technical delays of a software launch.

You get an enterprise-grade Governance Hub and Operations Centre ready to use in days.

What’s wrong with using Microsoft Office to manage payroll operations?

Microsoft Office tools like Excel and Word are static. While they can hold a list of tasks, they cannot provide a live, user-stamped audit trail or enforce a governed review process.

In a spreadsheet, it is impossible to prove who completed a task, when it was done, or if a mandatory peer review actually took place. Paytools replaces these manual files with Smart Checklists that:

-

Enforce Accountability: Every step is time-and-user stamped, creating an undeniable record of work.

-

Formalise Reviews: Built-in “Four-Eyes” checks ensure high-risk tasks are verified before the pay run can proceed.

-

Centralise Institutional Knowledge: Your SOPs are embedded directly into the workflow, rather than being buried in a Word document that no one opens.

Ultimately, Paytools replaces unreliable manual lists with a governed system that captures the who, when, and how of every task – giving you a permanent record of compliance that a spreadsheet simply cannot provide.

How does Paytools pricing work?

As a Software as a Service (Saas) platform, the Paytools pricing is simply an annual license fee based on the number of users.

Does Paytools integrate with Microsoft Teams?

Yes. Paytools integrates with Microsoft Teams to bring your Payroll Operations into the flow of your workday.

Receive automated daily digests and real-time notifications directly in your team’s channel, ensuring everyone is aligned on upcoming deadlines and overdue tasks without having to leave the chat.

By submitting this form you’re agreeing to join our mailing list. If you don’t find our communications valuable, please unsubscribe any time. For more info, see our Privacy Policy.