Sign up to attend our free payroll breakfast in Perth: Avivo’s Journey to Elevated Payroll Operations & Governance Using Paytools.

PAYROLL OPERATIONS PLATFORM

Elevate payroll to a trusted business partner

Paytools brings together your operational, people and compliance management into one platform.

Improve governance and create a sustainable payroll team with our purpose-built software.

PAYROLL OPERATIONS PLATFORM

Elevate payroll to a trusted business partner

Paytools brings together your operational, people and compliance management into one platform.

Improve governance and create a sustainable payroll team with our purpose-built software.

Customers who have levelled up their payroll operations & governance

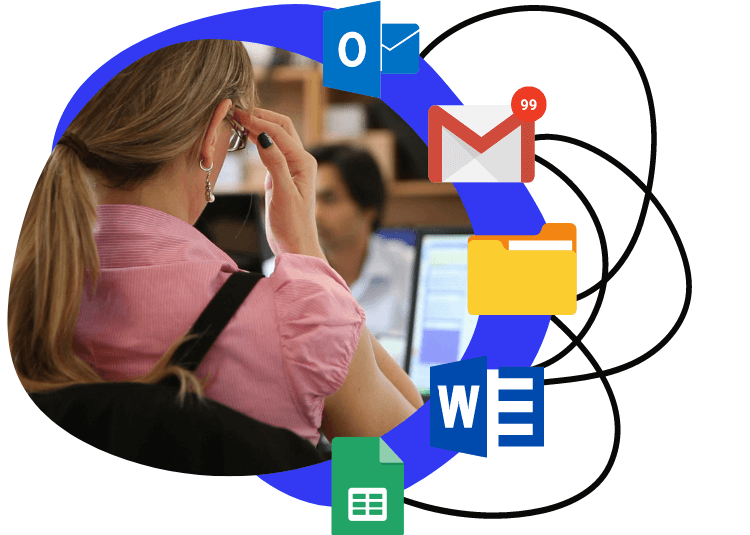

Using Word, Excel & Outlook to manage payroll?

Are you managing payroll across a disparate collection of Microsoft Office files? Yes it works, but you’re prone to issues including:

![]() Outdated, hard to find process documents / checklists

Outdated, hard to find process documents / checklists

![]() Inability to see where work is up to and who is doing what, when

Inability to see where work is up to and who is doing what, when

![]() Difficult for new starters to get up to speed quickly

Difficult for new starters to get up to speed quickly

![]() No set schedule of hygiene checks & proactive reviews

No set schedule of hygiene checks & proactive reviews

![]() Time consuming to provide auditors with requested information

Time consuming to provide auditors with requested information

![]() No centralised response & recovery plans for identified risks

No centralised response & recovery plans for identified risks

It’s time to use better tools to manage and orchestrate payroll.

8 essential requirements for payroll governance

The Fair Work Ombudsman is targeting inadequate record keeping & governance and controls, making expectations in payroll governance higher than ever. Here’s 8 essential things you should be doing… and how to do them.

- 1. Payroll work schedule

- 2. Process docs & checklists

- 3. Controls & proof of work

- 4. Reviews & hygiene checks

- 5. Issue & error register

- 6. Risk management

- 7. Monitoring & reporting

- 8. Education & training

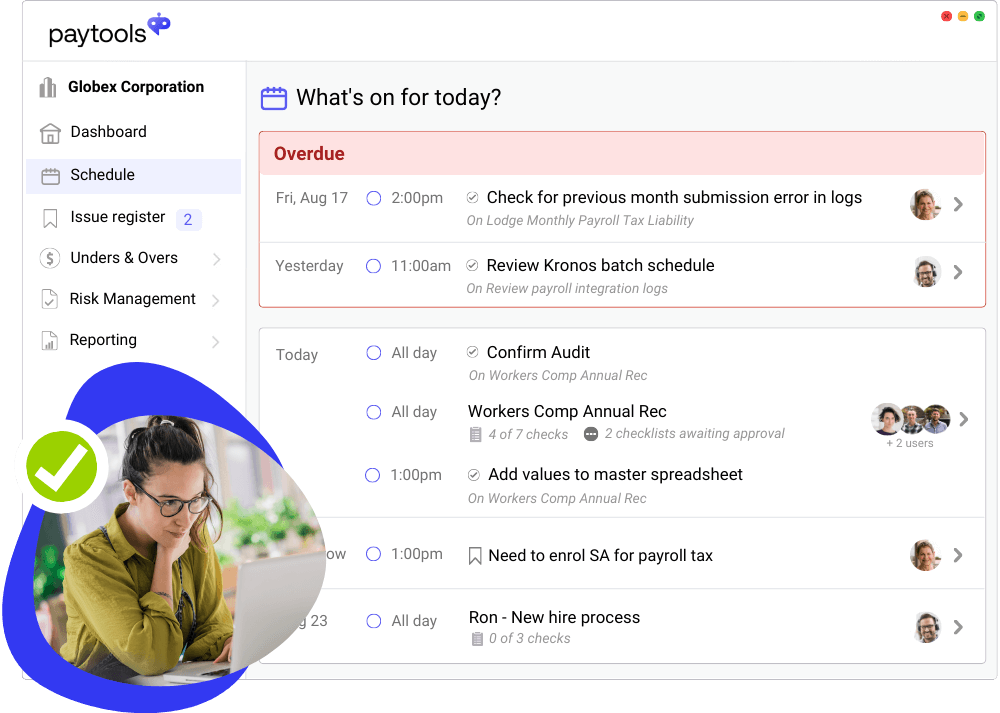

Payroll Work Schedule

Involves calendarising payroll obligations to ensure all processes, deadlines and reviews are captured and shared.

How Paytools can help you meet this requirement:

Payroll Calendar

Create a shareable ‘schedule of truth’ for all payroll obligations.

Obligation Tracking

Identify and schedule reviews on legislative, workplace and policy obligations.

Pay Run Processing

Configure timings, checkpoints and approvals with detailed checks over the course of a pay cycle.

Process Documentation and Checklists

Documented processes and checks to ensure accuracy and consistency of how things are done.

How Paytools can help you meet this requirement:

Smart Process Documentation

Build rich how to documentation that can be updated in real time and linked to workflows.

Pay Run Processing

Use re-usable checklists to ensure consistency on complex processing.

Controls and Proof of Work

Monitor activity, reduce risk, errors and perception of fraud. Provide your team a secure, auditable process to prove that the work has been done.

How Paytools can help you meet this requirement:

Controls and Roles

Assign approvers to key tasks to ensure completion.

Attach commentary and evidence to completed work.

Reporting and Audit

A full audit log of all work performed and evidence gathered.

Pay Run Processing

Use re-usable checklists to ensure consistency on complex processing.

Reviews and Hygiene Checks

Scheduled proactive maintenance, checks and housekeeping.

How Paytools can help you meet this requirement:

Obligation Tracking

Register your workforce instruments, assign owners, risk ratings and schedule regular reviews.

Payroll Calendar

Setup recurring reviews tied to checklists and processes to promote pro-active health checks.

Learning and Development

Track development of your team and see at a glance who needs training.

Issue and Error Register

Formal tracking and register of actions impacting payroll operations.

How Paytools can help you meet this requirement:

Issue Tracking

Formalise tracking of payroll issues and keep full audit trails of actions and decisions made.

Unders and Overs

Record, manage and analyse underpayments and overpayments.

Reporting & Audit

A full audit log of all work performed and evidence gathered.

Risk Management

Identify, categorise and mitigate payroll risks.

How Paytools can help you meet this requirement:

Risk Management

Pinpoint and assess risks that can impact payroll. Create and drill response checklists that get enacted and assigned if a risk occurs.

Obligation Tracking

Register your workforce instruments, assign owners, risk ratings and schedule regular reviews.

Payroll Calendar

Setup recurring reviews tied to checklists and processes to promote pro-active health checks.

Monitoring and Reporting

Involves the payroll function providing regular structured reports to senior leaders.

How Paytools can help you meet this requirement:

Reporting and Audit

Report on key operational metrics and retain a full audit history of work performed with evidence.

Ticketing Analytics

Identify problems, plan based on metrics and improve support desk performance.

Team, Education and Training

Making sure you have the right people onboard and keeping them trained and up-to-date on the payroll domain.

How Paytools can help you meet this requirement:

Learning and Development

Track development of your team and see at a glance who needs training.

Ticketing Collaboration

Work as a team to manage payroll enquiries, build a knowledgebase and response templates for common payroll queries.

Paytools benefits across different roles

PAYROLL MANAGER

Reduce team burnout by managing & tracking all payroll activities in one platform. Improve how you manage risk, compliance & onboarding.

PAYROLL PROFESSIONALS

Easily understand what needs to be done and how to do it. Less stress & dependency on individuals to know everything.

PAYROLL OWNER (CFO/HRD)

Introduce better detail & transparency across all complex payroll operations. Reduce key person risk.

C-SUITE

Elevate your payroll governance practices, which helps to minimise the risk of brand damage & compliance issues.

Explore our features

Payroll Calendar

Create a shareable ‘schedule of truth’ for all payroll obligations & processes.

Pay Run Processing

Use checklist templates, workflows & notifications to manage pay run tasks.

Smart Process Documentation

Build detailed workflows & process documentation for tasks in your calendar.

Issue Tracking

Raise & track issues from pay processing & other events. Track & report on progress.

Unders & Overs

Record, manage & analyse underpayments & overpayments.

Obligation Tracking

Identify & schedule reviews on legislative, workplace & policy obligations.

Risk Management

Formalise how you manage & treat risks, perform drills & track incidents.

Learning & Development

Track what training your team is receiving & find more education opportunities.

Controls & Roles

Set controls, allocate roles by pay group, define RACI matrix for key obligations

Reporting & Audit

Monitor & report on compliance areas. Capture full audit trail of actions.

Support Ticketing

Automate repetitive tasks so you can easily prioritise, categorise & assign tickets.

“Paytools provides comfort and oversight to management that essential activities are being completed on time.”

“It’s fantastic to finally have software dedicated to payroll ops. I couldn’t recommend Paytools more highly.”

“I wish Paytools existed when I was a Payroll Manager, it’s a game changer! It helps us and our clients do payroll better.”

FAQs

What is a payroll operations platform?

A dedicated platform (yes, just for payrollers!) to centralise payroll operations, streamline manual practices and ensure good governance.

This includes payrun checklists, process documentation, workflows, approvals, obligation tracking and issue and risk management.

How does Paytools pricing work?

As a Software as a Service (Saas) platform, the Paytools pricing is simply an annual license fee based on the number of users. Our license fees are all inclusive (no additional charges for implementation, training or ongoing support).

For further information on pricing for your organisation, please book a chat.

Can I purchase Paytools modules separately?

The payroll operations and governance features are included as part of the annual license fee. The support ticketing feature is an optional add-on.

For further information on pricing for your organisation, please book a chat.

How long does it take to implement Paytools?

Hours. Seriously, a few hours. We can have your environment set up and even help upload existing checklists and documentation prior to the first training session which takes just a couple of hours.

Our training and support is all included so we continue to support you in getting started and optimising your use of the Paytools platform.

Does Paytools integrate with Microsoft Teams?

Yes! We recognise that payroll teams often use MS teams to communicate.

Paytools has an in-built integration to MS Teams enabling notifications and daily digests to be automatically sent to one or many channels. This helps the payroll team easily keep track of what’s going on.

What’s wrong with using Microsoft Office to manage payroll operations?

Don’t worry, there is still a place for our beloved Excel! But there are many inefficiencies and transparency challenges in using disparate spreadsheets, documents, shared drives, emails, chats and calendars.

The Fair Work Ombudsman is targeting inadequate record-keeping, governance and controls so bringing knowledge into one platform is more important than ever.

What is payroll governance?

Boring but necessary! Payroll governance is the practice of demonstrating compliance with obligations, managing and minimising payroll risks and providing oversight and transparency.

This is often difficult to practice without a centralised platform, which is why payroll is often referred to as a ‘black box’ by stakeholders.

Learn more in our free whitepaper: The Australian Payroll Governance Toolkit

Do you connect to the payroll system and store payroll data?

No, and IT departments love us for it! Paytools sits alongside your payroll system as an operations management platform but does not need to integrate or store sensitive payroll data.

Proof of work or other sensitive information can be referenced with links to your own secure storage locations.

Does Paytools help in payroll remediation or enforceable undertakings?

We are not remediation consultants but we can recommend excellent consulting partners to help you with remediation.

Our partners often use Paytools for client engagements to enable customers a solution to track and implement consultant recommendations, with the option to continue using Paytools for best practice operations and governance moving forward.