Overview

Recently, we heard from Daniel Watson (Senior Payroll Manager at Cerebral Palsy Alliance) to understand how he is setting a new standard for operational excellence in payroll.

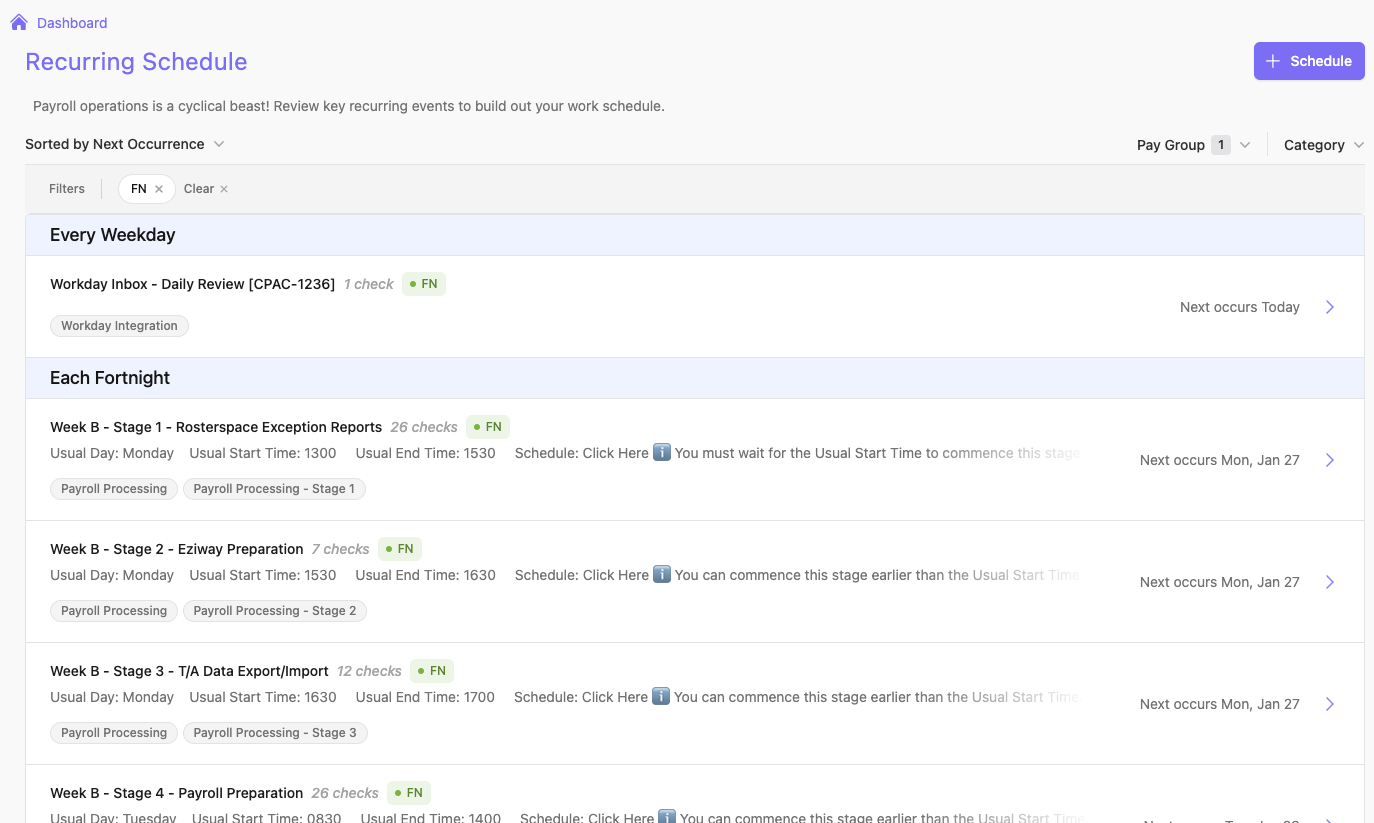

In this article, we will outline how Daniel has transformed his payroll department with the use of Paytools, enabling his team to:

💎 Reduce their time to run the payroll process by an entire day

💎 Significantly improve team development and onboarding for new starters

💎 Embed better transparency and governance practices across payroll

About Cerebral Palsy Alliance

CPA is a non-profit organisation with 2,700 employees dedicated to improving the lives of people with cerebral palsy. The CPA payroll team, consisting of ten professionals, handles complex salary packaging and runs on a fortnightly pay cycle.

They use a combination of Workday, Roster Space and Preceda as their core systems, as well as Microsoft Teams for communication and SharePoint for document/file management. CPA are moving payroll systems to Affinity and using Paytools to assist with the transition.

Challenges in Payroll Management

CPA faced several issues, including-

- Lack of a shared payroll calendar: Everything was managed in people’s heads.

- Manual Excel checklists: A pay run took four days to complete.

- Paper-based processes: Documentation was hard to find and update.

- No audit trail: Difficult to track when and by whom processes were completed.

- Informal issue management: No systematic way to log and resolve issues.

- Ineffective risk management: Managed via an Excel spreadsheet.

Pay run processing

How payroll was operating before

6 months ago, CPA’s payroll process was managed through a 30-page printed Word checklist (originally created in 2017), requiring manual updates and physical handling.

This out-dated way of working made the pay run process heavily reliant on memory and vulnerable to error, especially when key team members were on leave or had moved on.

After being introduced to Paytools work management software, Daniel realised he could boost payroll efficiency quickly and without a huge investment – which then drove a business improvement initiative for CPA.

After Paytools

CPA transformed its payroll processes by moving their outdated checklists into a dedicated payroll work management platform. Once his team we’re set up and using Paytools, the biggest changes included:

-

- More efficient pay runs: Tasks on pay day were now completed by 5pm instead of 7pm.

- Improved issue management: Proactive logging and categorisation of payroll-related issues.

- Enhanced team learning: A learning and development module tracks training progress.

- Upgraded risk and obligation management: Transitioned from Excel-based to proactive risk response plans.

- Comprehensive audit tracking: All activities are logged and easily filtered.

Key Business Outcomes

Implementing Paytools led to significant benefits:

-

- Operational efficiencies: Processes are now more clear and easily kept up to date, allowing the CPA team to reduce pay run processing times by 30%.

- Embedded governance: CPA Executives have a better understanding of the payroll function, with full transparency of payroll operations, obligations, issues and risks.

- More efficient processes: Allow the payroll team to finish tasks by 5 pm, avoiding team burnout.

- Team up-skilling: Training time for new staff has been reduced from six months to run a pay run, down to just one month!

- Smoother system migrations: With Paytools, CPA is set up for a quick and easy payroll migration project.

Download the full case study

Want to learn more about how CPA uses Paytools? Download our case study PDF today to get more in-depth insights, real-life examples and images from the tool.

- Payroll challenges CPA was able to solve, including pay run processing and issue management.

- Key business outcomes of using Paytools.

- How CPA got started with Paytools and what’s next in their radar.

By submitting this form you’re agreeing to join our mailing list. If you don’t find our communications valuable, please unsubscribe any time. For more info, see our Privacy Policy.