Overview

At Paytools, we believe in cultivating a culture that is focused on empowering employees and continuous learning. We take pride in developing people personally and professionally.

That’s why we’ve put together this article outlining why team learning and development should be a non-negotiable (especially in payroll) and some best practice tips on how to keep on top of it.

Why is payroll learning and development important?

We’re all sensing a shift in payroll.

There’s no question that getting people paid has always been critical, but organisations are now starting to appreciate how complex and underinvested payroll is. It’s only taken billions of dollars in underpayments and hundreds of enforceable undertakings by the Fair Work Ombudsman..

So, time to strike while the iron is hot! There’s never been a better time to make your case for payroll investment.

How to build a business case for payroll L&D investment

Here’s a few points that will help your sell your business case for investing in payroll internally:

-

- Improved efficiency: Well-trained payroll professionals work more efficiently, saving time and resources. With the right tooling, you can improve and streamline processes, automate tasks and troubleshoot issues more effectively, leading to increased productivity across the payroll function.

- Compliance and accuracy: Payroll involves complex calculations and legislation. Proper training ensures that your team will better understand these regulations and can accurately process payroll, reducing the risk of errors and non-compliance.

- Cost savings: Errors in payroll processing can be costly, leading to penalties, fines and potential legal issues. Investing in training will help you mitigate these risks by reducing the likelihood of mistakes.

- Employee satisfaction: Payroll is critical to your employee experience. Accurate and timely payment of wages is essential for employee satisfaction and morale. Investing in payroll will show your team that we’re committed to ensuring success in their roles.

- Adaptability to change: Payroll processes and regulations are constantly evolving. Investing in L&D and the latest tech to manage it will ensure that your team remains up to date with the latest changes and the organisation remains agile and competitive.

- Reputation protection: Accurate and reliable payroll processing will enhance your organisation’s reputation as a trustworthy employer.

– Dan Watson, Senior Manager Payroll

The best practice approach to payroll learning and development

It should come as no surprise that providing your team with access to training and educational resources is the best way to nurture their professional development.

To ensure that your team has the knowledge they need to navigate this ever-changing landscape, make sure that your payroll strategy includes a budget for regular training and the tooling required to successfully manage these commitments.

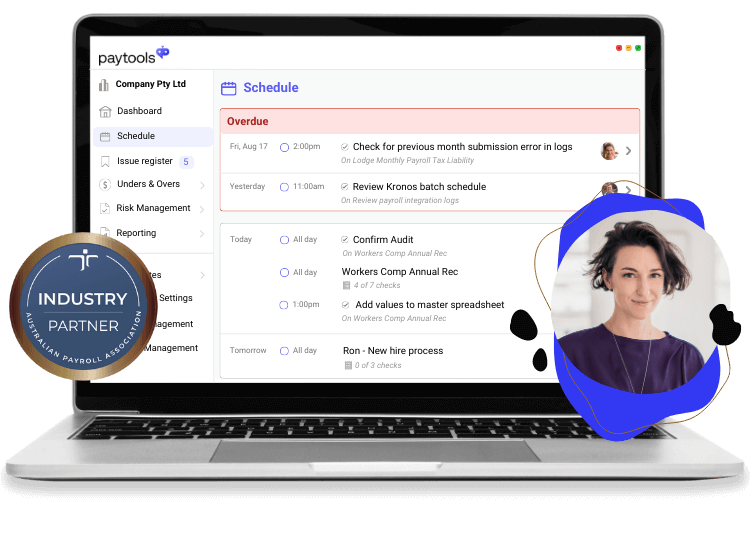

Investing in your team also means creating time for them to prioritise their professional development (hint: We love time blocking). You can also use emerging tech in payroll (like Paytools) to help improve efficiency which will in turn, create more time for your team to upskill.

Watch this 2 minute video where the Senior Payroll Leader from Cerebral Palsy Alliance shares how he’s using tech to achieve his L&D strategy goals moving forward:

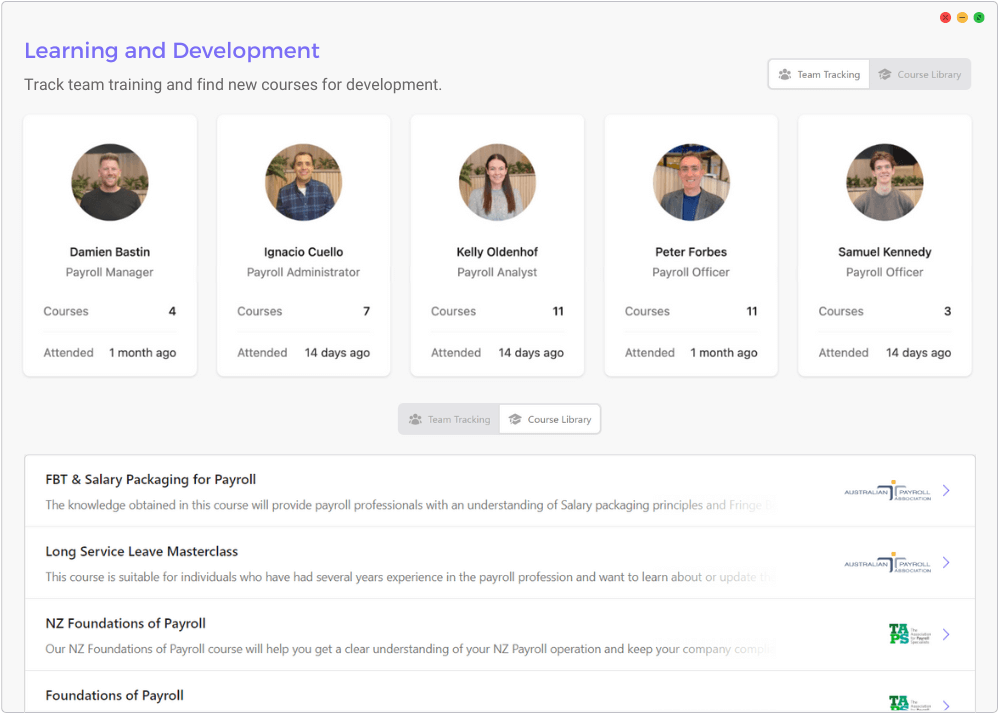

Below is an example of our learning and development module in Paytools.

This feature provides a best practice approach for organisations to manage team training. It shows what team members have completed courses, as well as provides a library of courses from the top payroll associations across Australia. This enables you to keep a complete audit trail of certifications, plus you and your team can easily find more opportunities for development.

What to consider when creating a L&D strategy for payroll

Here’s a few points to keep in mind when developing a L&D strategy for your organisation:

Create a culture of continuous learning

Set an expectation for your team to engage in lifelong learning as part of the profession. By providing access to regular payroll courses and training, you are supporting your employees to grow in their role and to position themselves as a valued and informed member of the team.

Leverage technology

If you’re not leveraging technology to become more efficient, you might be replaced by someone who will! Staying informed about the latest payroll tech will help you identify opportunities to improve how your team operates.

Work toward better practices

Set a new standard for payroll and achieve operational excellence across all your processes. This involves a best practice approach to payroll processing, documentation, analysing performance metrics and leveraging technology.

Tighten your approach to compliance

You and your team should be well-versed in state and federal laws regarding leave, taxation, superannuation, workers’ compensation, etc. Conducting regular compliance reviews and audits will help you reduce risk for your organisation.

Prevent Fraud

Understanding the various aspects of payroll fraud and implementing strong controls to mitigate risks is essential. Time to get proactive by conducting regular audits, segregating duties and adopting best practices in data security.

Embrace networking

Encourage your team to develop and sustain a professional network within the payroll community to gain valuable insights, advice and support. Engage in industry conferences, forums, webinars and join professional associations to connect with peers and stay updated on industry trends.

HINT: Paytools can get you on the fast track to solve all of these!

Top payroll learning sources in Australia

In Australia, there are several reputable sources for payroll learning and development. Here are some of our top recommendations:

- 1. Australian Government Websites: Government websites such as the Australian Taxation Office and the Fair Work Ombudsman offer free resources and guidance on payroll regulations, tax laws, and employment standards in Australia. These resources are essential for understanding and complying with legal requirements.

- 2. Australian Payroll Association (APA): The APA offers a range of training courses, workshops, and resources specifically tailored to payroll professionals in Australia. They cover topics such as payroll legislation, compliance, and best practices. The APA also provides certification programs for payroll professionals.

- 3. The Association for Payroll Specialists (TAPS): is a member-based community specialising in advice, training, recruitment & payroll health checks. Improve your skills and increase your expertise at our educational conferences and instructor led training.

- 4. Australia Wide Taxation & Payroll Training: specialise in conducting taxation and payroll training seminars. Their taxation and payroll training has been formulated to ensure that relevant up-to-the-minute information is passed on to attendees in an easy-to-understand format.

- 5. Online Training Platforms: Online learning platforms like LinkedIn Learning, Udemy, and Coursera offer a variety of courses on payroll-related topics. These courses cover everything from payroll fundamentals to advanced topics like payroll software and systems. They often allow learners to study at their own pace and from anywhere with an internet connection.

- 6. Payroll Software Providers: Many payroll software providers offer training and certification programs for their products. These programs teach users how to effectively use the software to process payroll, manage employee data, and generate reports.

- 7. Local Tertiary Institutions: Universities, TAFEs (Technical and Further Education institutions), and other educational providers in Australia offer courses and qualifications in accounting, finance, and business administration that include modules on payroll. These courses can provide a more comprehensive understanding of payroll within the broader context of business operations.

Final thoughts

It’s time for payroll to take the lead when it comes to achieving operational excellence as a department and learning and development is a great place to start. Invest in your team to break away from the old and move into a better, more modern mindset.

Paytools is renowned for delivering simple-to-use technology that helps payroll to become a trusted and valued partner to the business. Book a demo today to learn how we can help you set a new standard for payroll.