Why Continuity Matters and How to Strengthen Your Payroll Resilience

Payroll is one of the most business-critical functions in any organisation. When people aren’t paid correctly or on time, your organisation can face real financial and compliance risks. Yet, payroll is often under-resourced when it comes to risk management and business continuity planning.

Recent large-scale outages – such as the AWS service disruption that impacted businesses globally – have highlighted one key truth: incidents are no longer hypothetical. They will happen, now and in the future.

The new question is not if, but how prepared your payroll operation is.

Good news: with modern tooling – the process of preparing, documenting and testing payroll continuity has become easier than ever before.

🚧 What Happens When Payroll Isn’t Prepared?

Even a short outage or internal disruption can cause payroll delays or errors.

Consequences often include:

- Late or incorrect pay leading to employee dissatisfaction and escalations

- Compliance breaches around tax, superannuation and award conditions

- Financial risk including penalties, remediation costs and duplicated effort

- Operational disruption across HR, finance, rostering and leadership

- Reputational damage both internally and externally

Incidents like the AWS outage reveal how interdependent payroll systems are – cloud-based HCMs, time and attendance platforms, banking services and even authentication systems. A single point of failure upstream can cascade across the entire payroll function.

This is why practical, repeatable and tested business continuity planning is essential.

🧪 How Do You Test Payroll Business Continuity?

Having a plan is one thing; knowing it actually works is another.

Mature payroll functions adopt a cycle of:

1. Risk Identification

Documenting risks such as system outages, key-person dependency, integrations failing, corrupted import files, banking delays or security breach issues.

2. Response Planning

Establishing what to do when each risk is triggered – who acts, in what order, using which data and tools.

3. Scenario-Based Testing

Running practice sessions such as:

- Tabletop walkthroughs

- Simulation of system outages

- Mock pay cycles

- “Key person unavailable” tests

- Communication drills

This ensures your team can confidently execute the plan during real incidents – not discover gaps under pressure.

🛠️ How Paytools Helps Teams Build Confidence & Resilience

Modern payroll teams now have access to purpose-built technology to reduce risk and improve continuity. Paytools includes several features designed specifically for practical, operational resilience.

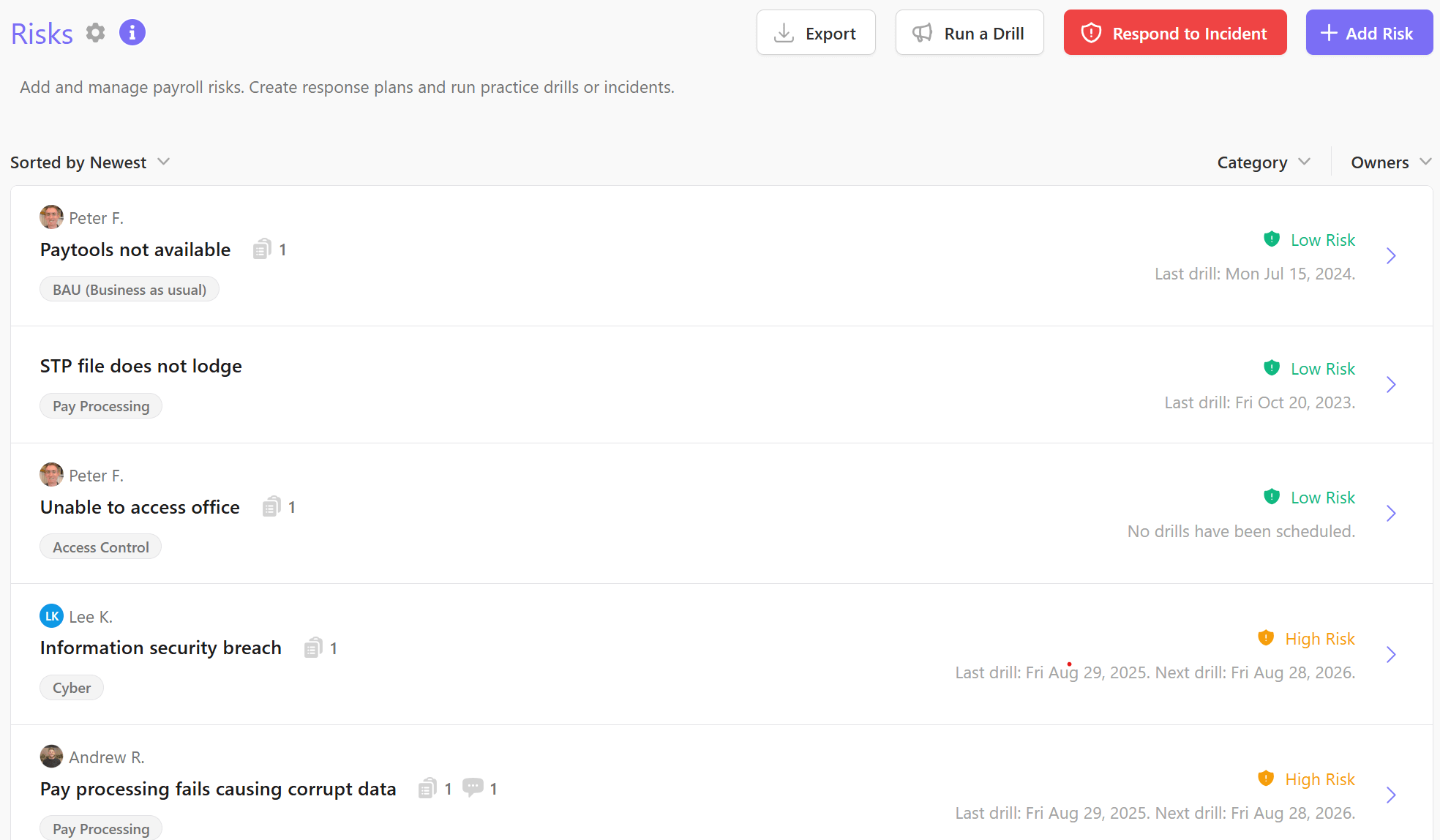

📋 Risk Register: Centralised, Living Risk Management

What it is: A structured, easy-to-maintain register where payroll teams document every identifiable risk – from system dependencies to process bottlenecks and team capacity.

How it benefits you:

- Creates a single source of truth for all payroll risks

- Reduces reliance on institutional knowledge

- Allows owners, mitigations and controls to be tracked and updated easily

- Makes risk conversations with finance, HR and leadership clearer and evidence-based

Instead of risks being buried in spreadsheets or remembered only by senior staff, the Risk Register keeps everything visible, current and actionable.

📚 Response Plan Library: Best-Practice Templates Ready to Use

What it is: A collection of ready-made continuity and incident response plan templates built using industry best practice – covering system outages, data loss, staff absence, banking failures, integration disruptions, payroll calendar clashes and more.

How it benefits you:

- Accelerates implementation of business continuity planning

- Ensures plans align with industry standards and compliance needs

- Removes guesswork in designing your first or next iteration of continuity plans

- Lets you customise templates to your organisation’s workflow, tools and approval chain

With these templates, payroll teams no longer need to start from scratch to build continuity documents.

🧑🏫 Scheduled Drills: Annual Tabletop & Scenario Testing

What it is: A built-in scheduling tool that prompts you to run annual or quarterly resilience tests – like tabletop exercises – so key staff can walk through your continuity plan together.

This includes:

- Structured exercises

- Guided prompts

- Automated reminders

- Clear documentation of what worked and what needs improvement

How it benefits you:

- Ensures regular testing without relying on memory or manual reminders

- Builds team confidence in handling real-world incidents

- Identifies gaps before they cause an actual failure

- Demonstrates organisational diligence and governance

Running drills becomes simple, predictable and part of your natural payroll rhythm.

🌱 A Positive Shift

Payroll teams have always worked incredibly hard under pressure. The challenge historically has been a lack of tools, not a lack of skill or commitment.

What’s changing now is that the technology and frameworks finally exist to support payroll teams in building stronger, more resilient practices with far less effort. Paytools is designed specifically to make this uplift achievable, practical and ongoing.

🚀 Build Resilient Payroll Operations with Paytools

Whether you’re starting your first continuity plan or maturing an existing framework, Paytools gives you the structure, templates and testing cycles you need to manage payroll risk effectively.

If you’d like to learn more about Paytools, book a demo today!