Overview

In the world of payroll management, stress often comes with the territory. Long hours, holiday crunches and the constant pressure to meet deadlines can make payroll a source of anxiety for many teams. However, by adopting a structured approach, these stressful scenarios can be minimised.

This blog explores how to transform your payroll operations using the “Four Box Approach” and best practices for the perfect payrun. If you don’t feel like reading our blog, head on over to our webinar library and watch the full video.

The 4 fundamental steps of payruns

The 4-Box Approach is a powerful method that simplifies running the pays into four steps, making the entire process more manageable.

Master file management: The first step in the payroll process is Master File Management. This involves maintaining accurate records that dictate who gets paid and how much. Tasks include onboarding new employees, managing contract changes, applying global updates like pay rate adjustments and handling terminations. Getting this right from the start is important, as it sets the foundation for the rest of the payroll process.

Time and leave management: The next step is managing time and leave data. This is vital for ensuring employees are compensated accurately. Time and Leave Management covers everything from collecting and approving time sheets and attendance records to managing rosters and processing leave requests. Whether your workforce is salaried or hourly, capturing accurate data is essential for correct payroll calculations.

Validation and verification: The third step focuses on validation and verification. This is where you ensure the data you’ve collected is accurate and complete. You’ll run exception reports, balance calculations and verify every detail to catch any discrepancies before payroll is finalised. This ensures that you prevent errors that could lead to payroll delays or inaccuracies.

Disbursements: The final step in the payroll process is disbursement. This involves transferring payments to employees, making superannuation contributions and completing necessary reporting, such as STP submissions and issuing payslips. Disbursements are more than just moving money, they ensure all data is correctly reported and that every employee receives their pay on time.

Building a schedule for payroll success

Once you have structured your payrun process, the next step is to articulate a detailed schedule that ensures all tasks are completed efficiently. This schedule should be designed with a middle-out approach, starting with key deadlines and working backward so that everything aligns properly.

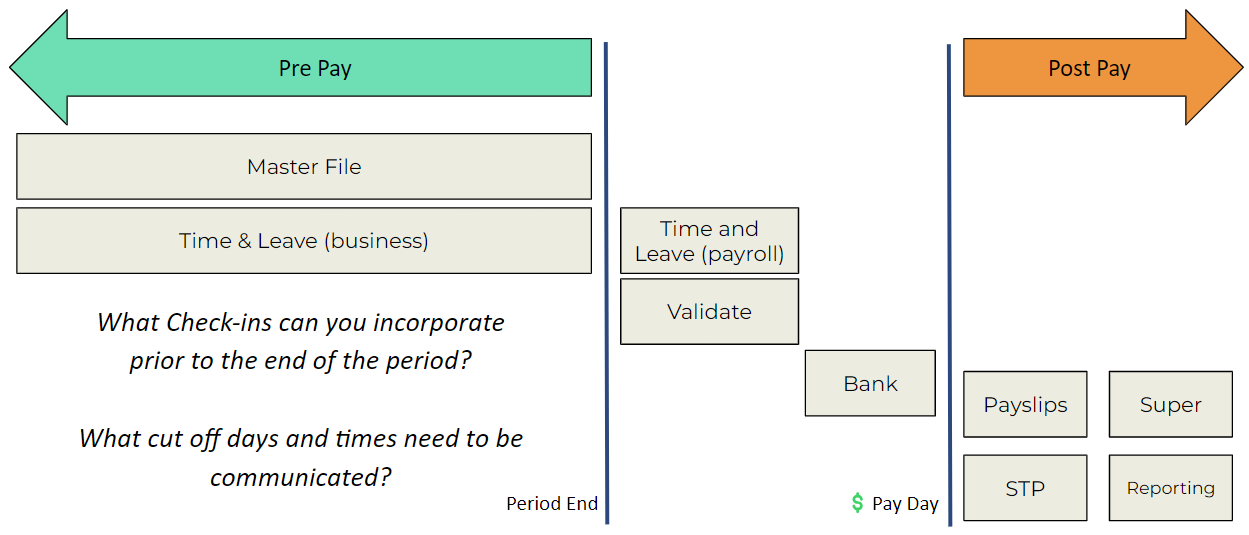

Understanding the payroll cycle

The payroll cycle is the broader framework where all payrun activities occur. It begins after the pay period ends, as the payroll team starts processing, verifying and disbursing payments. This cycle is distinct from the business’s view of the pay period, which focuses on when employees start and stop recording their time. This difference can sometimes cause confusion with non-payroll stakeholders who might not understand that payroll work often begins after the pay period ends.

For example, in Western Australia, payroll teams must complete banking tasks by midday due to time zone differences with Eastern states. This requires backward planning to ensure all necessary tasks are completed on time.

To manage this effectively:

Prepay Activities: Identify and complete tasks like verifying time sheets, processing new hires and handling contract changes before the pay period ends.

Payrun Processing: Focus on the actual payrun day, ensuring that validation, verification and banking tasks are completed by the necessary deadlines.

Postpay Tasks: After payments are disbursed, finalise reports, update records and prepare for the next cycle.

The essentials of payroll operations

There are four key areas you can immediately address to enhance your payroll operations:- Work Schedule

- Checklists

- Controls

- Oversight

- Reduced errors and missed steps, leading to fewer issues and less need for corrections

- Increased redundancy, ensuring more team members can handle the tasks

- Greater visibility into the detailed process, enabling you to improve and refine each stage of payroll processing

Work Schedule – Eat, sleep, pay, repeat

A published, detailed schedule keeps everyone aligned, preventing missed steps and tasks. While a static schedule or shared calendar can provide the necessary information, they are often not operationally effective.

Paytools offers dynamic scheduling capabilities, allowing you to view and manage all recurring and less frequent payroll activities in one central platform. This integrated approach ensures that nothing falls through the cracks, with reminders, task assignments and real-time updates keeping your payroll team on track.

Checklist – A clear standard for everyone

Checklists ensure every step of your payroll process is completed accurately and consistently. Unlike lengthy process manuals, which are often ignored during actual payroll processing, checklists provide a simple and effective way to ensure everything is done correctly.

Paytools enhances traditional checklists by integrating them directly into the payroll process. You can include detailed instructions, assign tasks, set deadlines and track changes. This integration replaces outdated manual checklists and ensures that all tasks are completed accurately and on time.

Controls – Guardrails of governance

Controls are essential mechanisms that ensure work is done correctly and that all tasks meet compliance requirements. Traditional tools like Excel checklists often lack the necessary controls to track who did what and when.

Paytools provides control features, including activity logging, comment sections for additional context and the ability to attach supporting documents. These features ensure that every step in the payroll process is documented and verifiable, reducing the risk of errors and ensuring compliance.

In the example below, you can see a complete audit trail and search by time period, user, category or activity type.

Oversight – Trust but verify

Oversight involves having a second set of eyes to review processes before they are considered complete. This practice, common in software development, is equally important in payroll to ensure accuracy and compliance.

Paytools allows you to set up default approvers for checklists, ensuring that all tasks are reviewed before completion. Notifications are sent to approvers when their attention is needed and all approvals are logged, making the process transparent and secure. Integration with tools like MS Teams further enhances team collaboration and communication, ensuring that everyone is on the same page.

Want to learn more?

Watch our full webinar to find out more about how you can plan the perfect payrun.

Ready to take your payroll process to the next level? Book a demo with Paytools today and see how our platform can help you achieve the perfect payrun.