It’s easy for busy payroll teams to ignore strategic thinking about the payroll function. Tight deadlines, pay runs need to be processed and a new crisis tends to emerge at least once a fortnight.

Time and again, payroll gets stuck as a back office function with little headspace to think about how it can evolve and become a trusted partnership with the business.

A new case of non-compliance or underpayment appears in the news every other week. It’s time for payroll teams to think strategically, build a plan and define the cadence around payroll operations and compliance activities.

That’s why we’ve put together this guide covering the core concepts of payroll compliance, plus a free PDF framework for building a payroll compliance strategy.

Key aspects of payroll compliance

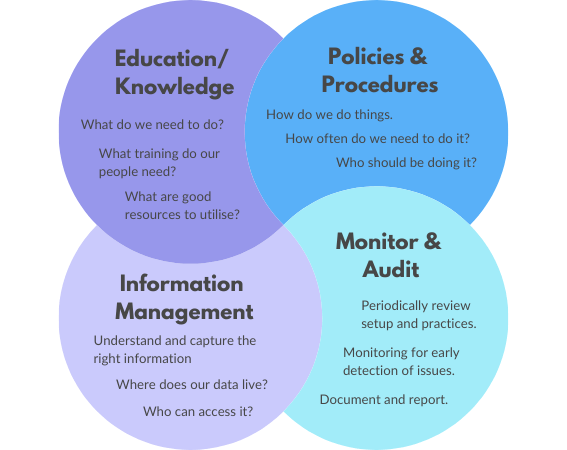

Being ‘payroll compliant’ covers a lot of ground. It involves a multidisciplinary approach involving education, processes, information management and continuous review.

Here’s an overview of the 4 key aspects of payroll compliance:

A framework for payroll compliance activities

Making sure that you’re payroll compliant means meeting your employee obligations against the relevant industrial agreements (e.g. earnings and entitlements) and statutory requirements like super guarantee and payroll tax.

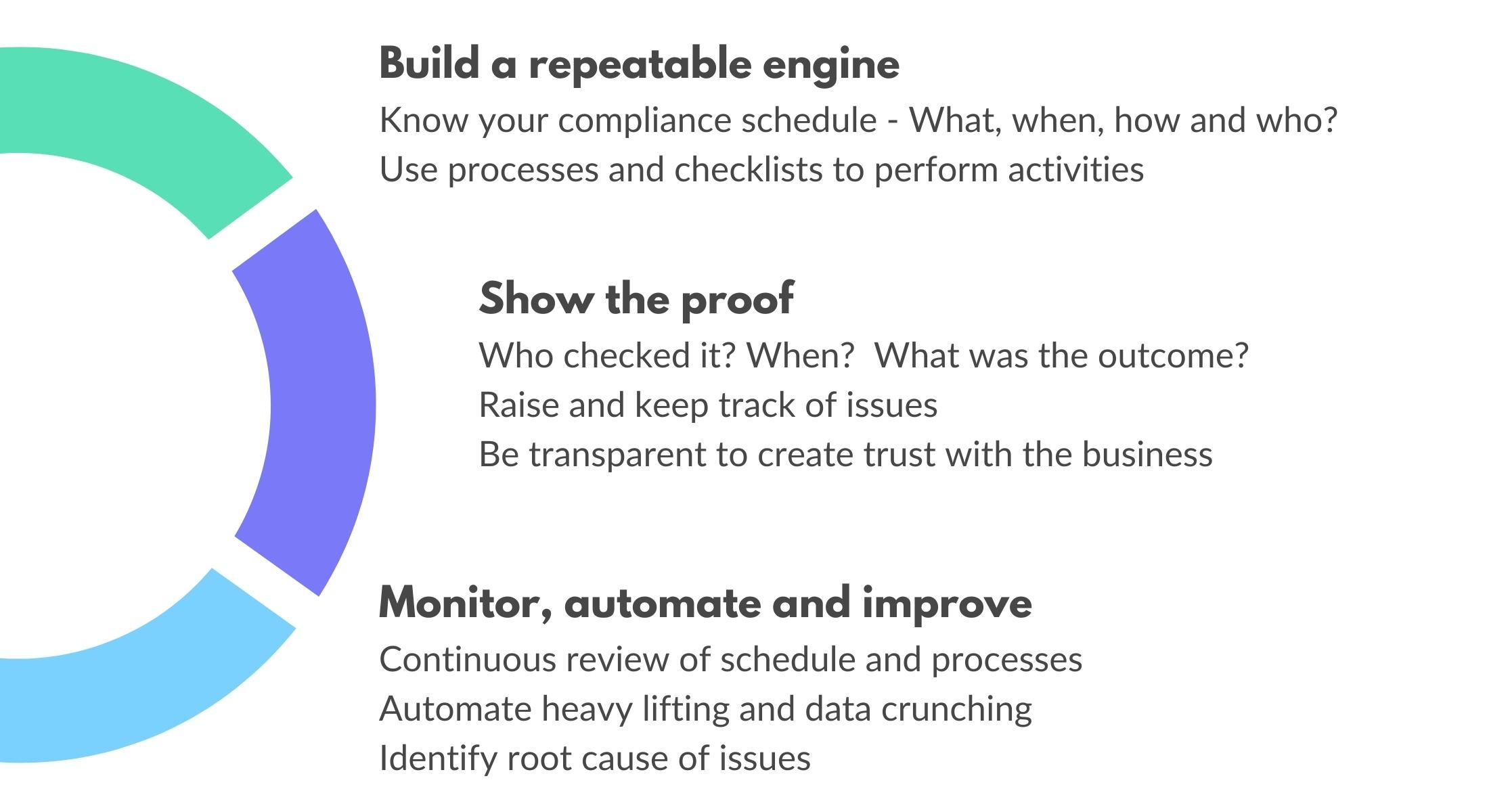

The key to a successful payroll compliance strategy involves defining and running a framework of repeatable activities, with documented evidence, that can be improved and automated over time.

a. Build a repeatable engine

What’s your compliance schedule?

Having a documented schedule of compliance activities enables everyone to understand what needs to be done, how, when and by who.

Most payroll compliance activities and deadlines apply to all businesses regardless of industry, making it easier for team members to see what might be missing from your schedule.

We recently put together an article with key payroll dates in an online calendar. You can print out a hard copy or import all the deadlines into your Gmail or Outlook calendar (we’ll be sure to keep them up to date for you).

Use documented processes and checklists to perform activities

Payroll operations involve complex legislation and precise processing of dollars and entitlements. A wrong configuration can have drastic downstream consequences that can go unnoticed pay after pay.

You wouldn’t land a plane or work on dangerous electrical equipment without running through detailed checklists, so why is complex payroll operations any different?

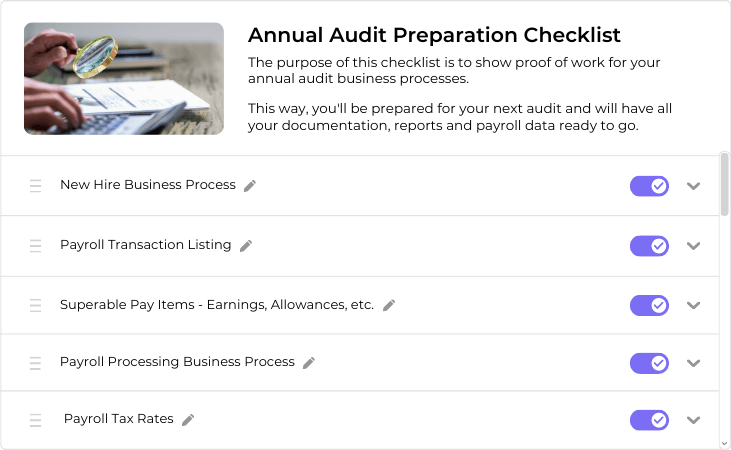

All repeatable compliance activities should have a checklist and documented process showing what needs to be done and how.

To give you an idea of what’s included in our templates, here’s a best practice checklist we put together for handling ABA files in payroll.

b. Show the proof

While it’s great to have a compliance schedule and documented processes and checklists, you need to show evidence that the required actions have been completed.

As you work through compliance actions, show your proof by taking screenshots, adding attachments and documenting the results.

Why do I need to show evidence of compliance activities?

- To give visibility to others in payroll and other departments that may have dependencies on those actions

- So any flagged issues can be raised and addressed appropriately

- It creates trust and transparency within the business

- Auditors will need to see this information

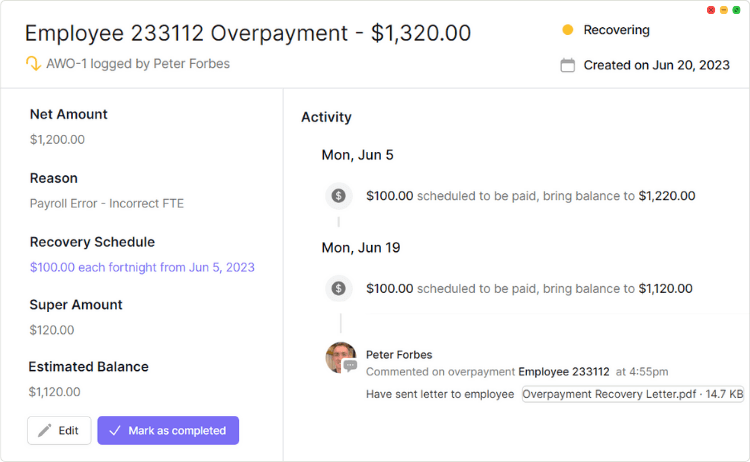

For audit purposes, you’ll need to maintain an issue register to keep track of problems that require further investigation. It’ll make your life a whole lot easier if you can manage this and other core compliance tasks in one central platform.

Using a payroll operations platform helps you to effectively work through all your compliance activities, plus allows you to add comments against every action (or raise an issue if needed).

c. Review, automate and improve

Continuously review your payroll activities & processes

A culture of continuous improvement (kaizen) is healthy for payroll teams to make sure payroll activities still reflect latest legislation changes, business and operational requirements.

Here’s some additional activities you can add into your schedule to ensure a continuous improvement approach:

At least annually:

– Annual payroll system configuration: Review critical system setting and user access setup

– Audit preparation: Make sure you’re ready for your next audit by having all your documentation, reports, and payroll data ready to go

– Bank File Handling: A self assessment of how you should be handling bank files

– End of Financial Year: Review rate changes (awards, payroll tax, etc), reconcile the previous financial year and prepare for the next

At least every 6 months:

– Access control review: Review users, roles and permissions in the payroll system to verify active users, segregation of duties and other breaches of user access

Every time you use them:

– Process review: The best time to improve a process is when you use it! Encourage the team to make a 1% improvement to the documented process each time it’s used. Overtime, these small improvements will make big gains to capturing how you do things.

Automate heavy lifting

Why automate? By minimising manual workflows, data entry and calculations – you’ll reduce the chance of errors and the need for manual intervention. Recurring, data intensive tasks are the low hanging fruit to tackle first.

A good example is implementing a timesheet solution to replace paper based timesheets. Not only does it eliminate manual data entry, it can also automatically interpret pay rates based on the employee’s award and hours worked reducing the potential for under or over payments.

Another example is scanning employee master data (EMD) for suspicious activity and data integrity issues. Catching bad data early prevents downstream issues when running pays.

It’s not practical or efficient to scan EMD manually so investing in technology is a strategic option to solve the problem.

What’s next?

Build sustainable payroll operations

Laying the foundation for a healthy payroll department involves 3 core areas: People and Culture, Operations Management and Technology and Automation. Check out our 8 essential items of Australian payroll governance article to learn more.

People & Culture

- The right people on the bus

- Team values/code of conduct

- Build a partnership with the business

- Key success metrics

- Operating calendar and rhythm

- Policies, processes and checklists

- Knowledge management

- Information management

- Sources of truth

- Systems and platform

Ready to get payroll governance sorted?

Book in a quick, no obligation chat to see how we can help you simplify and formalise your payroll governance program.

We’ll show you how to de-risk payroll, plus the many benefits of centralising payroll operations management using Paytools.

Don’t forget to download the free payroll compliance strategy framework.