Payroll is operating under increased scrutiny in a complex legislative environment with tight resource constraints.

Creating a framework to manage payroll governance reduces under/over payment risk and non-compliance, but the know-how and tooling is often not accessible to most organisations.

In this article and webinar we’re focusing on payroll governance, risk and compliance (GRC), more specifically: what’s happening in payroll today and what you can do to improve your payroll governance, risk and compliance practices.

The current governance and compliance landscape

Public scrutiny of boards in Australia are on the increase, particularly as attention on environment, social and governance (ESG) issues continues to grow.

A report by the Governance Institute of Australia argues that the board should lead on these areas – acknowledging their importance and embedding them into strategy.

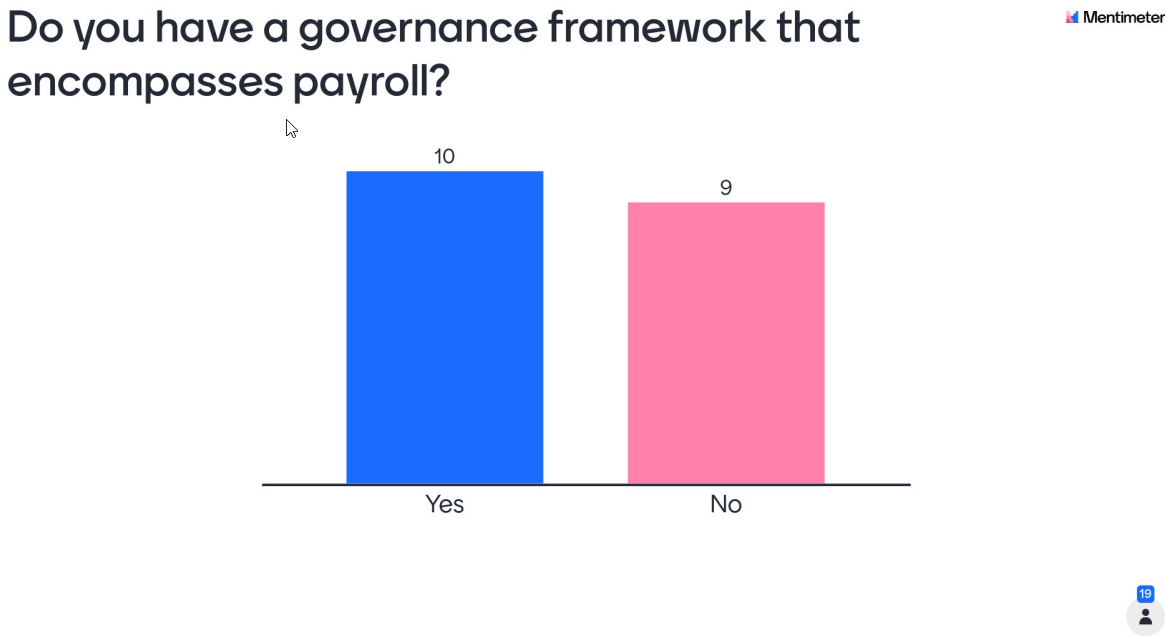

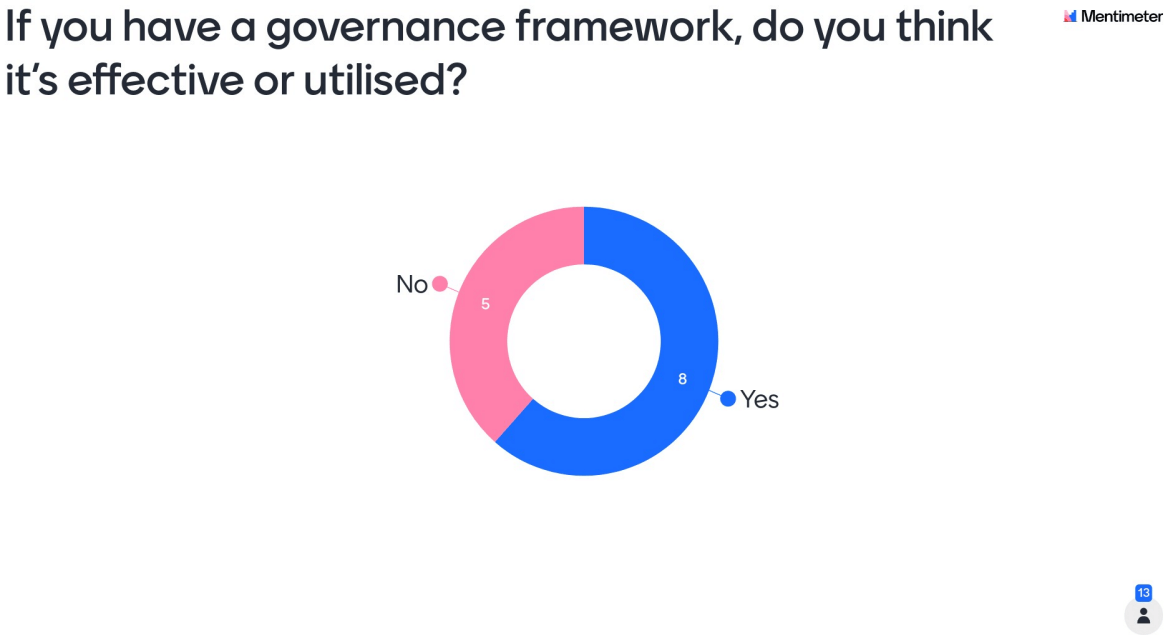

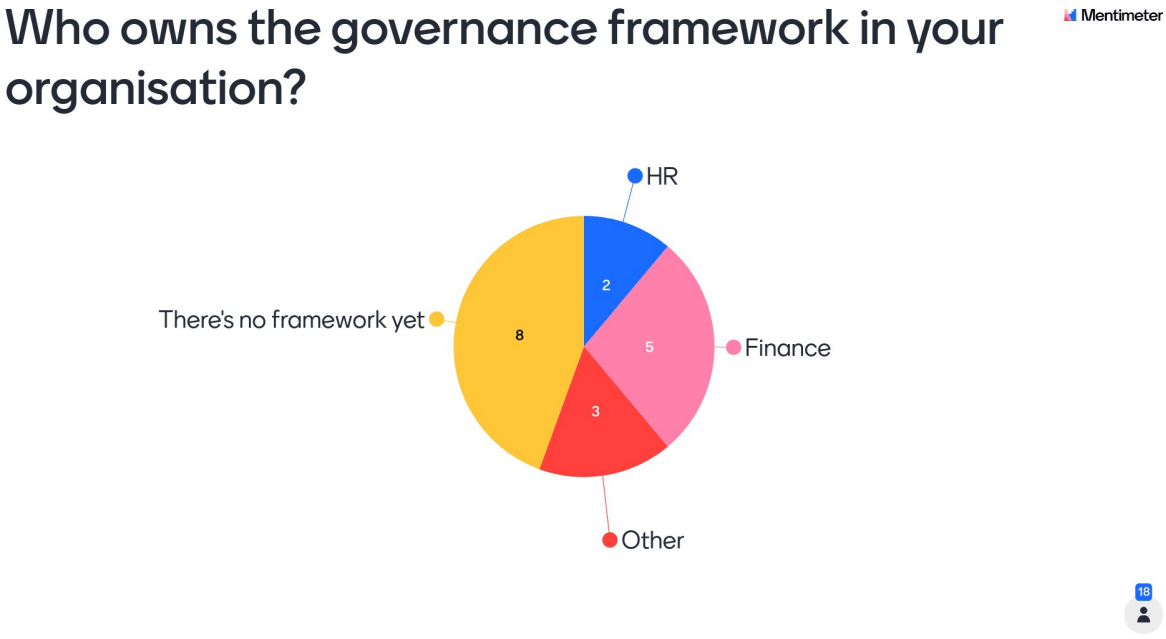

We took a quick poll recently to see where organisations in Australia were at with their journey to manage payroll governance. Here’s the results:

What’s involved with payroll governance?

It seems intimidating a first, but simply put – these are the ultimate goals of payroll governance:

-

- Preventing payroll errors, disruptions and delays to payroll processing

- Business continuity

- Demonstrable compliance with legislation and workplace requirements

- Auditability of work against documented processes

- Ongoing management with a structured schedule

- Proactive risk mitigation and control monitoring

What payroll governance isn’t

-

- A policy

- A procedure

- A HRIS, payroll or T&A system

- Once off plan/intervention/action

- Reactive management of issues

What issues does payroll GRC address?

-

- Inconsistent and/or undocumented processes, driving key person risks

- Lack of defined roles, responsibilities and segregation of duties

- A ‘set and forget’ approach to systems, policies and/or processes

- Lack of oversight and support, with limited visibility into payroll compliance requirements

- Low maturity of risk and issue management related to:

- Business Continuity Processes (BCP) and disaster recovery (DR) – unplanned, undocumented and/or untested

- Information security knowledge and practices

- Perceived vs actual fraud protections

GRC for managers accountable for the payroll function

Often accountable people don’t have visibility of those who are responsible – putting a lot of trust and pressure across the payroll team.

Responsibility can be shared, but accountability cannot.

Being accountable not only means being responsible for something but also ultimately being answerable for your actions. In small teams it’s easy to define this, but for larger payroll teams – things can get complex.

How do you improve the payroll function and reduce some of the risks?

Having a clear governance framework creates visibility and consistency and provides oversight from the business.

5 key areas to better manage payroll governance are:

Education and training

-

- Understand best practices – particularly in payroll hygiene and preventive actions

- Ensure operations are supported with appropriate managers / operational training

Payroll schedule and reviews

-

- Clear articulated key events and activities by compliance area

- Pro-active and leading reviews of systems, access and operations

Monitoring and reporting

-

- Risk/issue register

- Management reports and dashboard

- Audit preparation

- Proof of work

Roles and responsibilities

-

- Who is accountable for different areas

- Responsibility – who is doing the work

- Segregation of duties

Watch our webinar: how to manage payroll governance

Learn more on this topic in our recent webinar featuring 3x experts in the industry. See how a payroll governance platform can help you quickly and securely set up your payroll governance risk framework, as well as tips for building good controls and best practice in payroll..

Using payroll operations and governance software like Paytools, you can protect your organisation from under and overpayments. It can also enable you to easily demonstrate internally and to Fair Work that you’re compliant, today and into the future.

If you’re looking for a fast and secure way to get payroll governance sorted in your organisation – book a demo of Paytools. It’ll save you lots of time and will help to make sure you get right the first time.